I'm Leaking the Bids on Celsius Network's Assets

In December, I gained access to the bids on Celsius Network's assets. Binance, Galaxy Digital, Bank to the future, Cumberland DRW & Novawulf placed bids on Celsius Network's crypto.

On December 20, 2022, I received documents detailing the bids on Celsius Network’s crypto assets. I refrained from sharing the bids publicly to avoid disrupting the bidding procedures or negatively impacting customer recoveries; however, in yesterday’s Celsius Network court hearing (1/24/23), Kirkland & Ellis attorney Ross M. Kwasteniet proclaimed the bids “have not been compelling.” Celsius Network instead hopes to reorganize into a properly licensed, publicly-traded company and potentially issue a new “Asset Share Token.” Creditors never got a chance to evaluate the bids nor did most Celsius employees.

Previously, in September 2022, I leaked Celsius Network’s original stand-alone restructuring plan, “Kelvin” ( Full Transcript & Audio ), as well as their original Wrapped IOU Token plan ( Full Transcript & Audio ).

In case you’re curious about the bids on Celsius’s crypto assets, I’ll share them here on Substack since the bidding procedures seem to be, for the most part, abandoned. I’m also talking about the bids/my thoughts in this YouTube video.

Binance, Bank to the Future, NovaWulf, Cumberland/DRW, and Galaxy Digital were amongst the bidders on Celsius Network’s crypto assets.(Note: I’ve typed the bid out word-for-word & re-created the included graphic to avoid posting the source material.)

Binance Summary Term Sheet:

Transaction Structure:

Term Sheet Summary: Acquire and transfer all liquid and certain illiquid crypto at fair market value to Binance’s platform (users have option to participate)

Excludes $FTT, $CEL, certain non-liquid tokens, equity investments, mining, loan portfolio and fiat cash

Consideration:

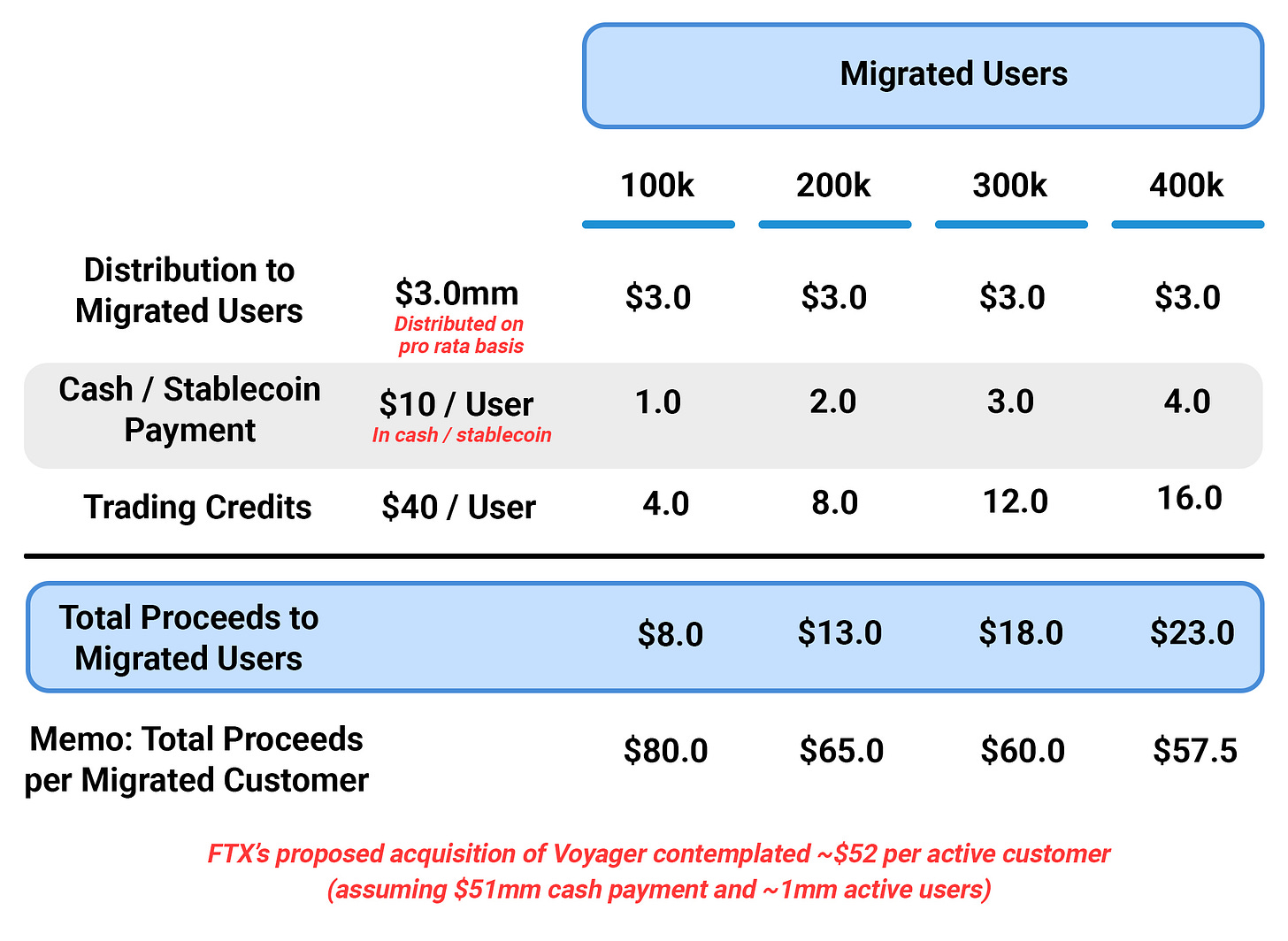

$15mm cash, comprised of $12mm to Celsius estate and $3mm distributed to migrated users on a pro rata basis.

Customer Incentives:

$50 in incentives for migrated users consisting of $10 in cash / stablecoin (I) and $40 in trading credits

Advisors:

In-house to engage advisors in second round

Conditions & Approvals:

Chapter 11 bankruptcy court and regulatory approvals

No exclusivity, no-shop nor break fee provisions.

Customer Consideration Sensitivity:

Transaction contemplates variable incentive payments for migrated users

As of September 14, 2022, Celsius has ~390k funded accounts with balances greater than $10

Source: Binance proposal as of November 21, 2022.

Note: Dollars in million, unless otherwise specified.

(I) Cash / stablecoin incentive conditioned on executing one trade with value greater than $10.

Bank to the Future Summary Term Sheet

Transaction Structure:

All liquid crypto assets and collateral returned to creditors pro rata through custody accounts managed by Bank to the Future

Customers given the option to voluntarily hold tokens in custody, stake or invest coins with Bank to the Future

Creditors to be offered incentives to transfer tokens including discounted staking, trading, retirement or wealth management fees (amounts not specified)

Creditors receive 100% equity interest in one or more SPVs comprised of mining, GK8 and other illiquid assets / tokens

Shares will be freely tradeable and governed by Section 1 145 of the Bankruptcy code

Consideration:

Estate: Market value of crypto assets and collateral; no consideration for acquisition of customers

Customer: Discounted trading / staking fees and retirement / wealth management services

Financing Source:

Cash raised through rights offering to creditors (amount TBD)

Advisors:

[REDACTED NAME FOR PRIVACY] (Legal)

Conditions & Approvals:

Bankruptcy and regulatory approval

Stalking horse protections including 3% break-up fee

Entry of final order by March 31, 2023 and Plan effectiveness by May 31, 2023

Source: Bank to the Future proposal as of November 21, 2022.

Note: Dollars in million.

Galaxy Digital Summary Term Sheet

Transaction Structure:

Acquiring all illiquid and staked ETH assets

Includes wallets at Fireblocks, Blockdaemon and Figment

Galaxy would seek to be designed stalking horse bidder for these assets

Number of staked ETH tokens subject to change pending increased block rewards generated over the pendency of the Chapter 11 proceedings

Consideration:

~$66.8mm, representing an 83% discount to the 5-day moving average price per unit of ETH

Financing Source:

Cash

Advisors:

In-house

Conditions & Approvals:

Staking horse designation under US Bankruptcy Code

Subject to auction on December 15th, Sale Hearing on December 22nd and transaction close by December 31st

Source: Galaxy proposal as of November 22, 2022.

Cumberland / DRW Summary Term Sheet

Transaction Structure:

Purchase certain tokens and portfolio of alternative investments

Excludes CEL token

Acquisition to be settled over 4 transactions

Consideration:

$1.8bn total consideration (1), consisting of:

$333mm for stablecoin

$583mm for liquid tokens (BTC and ETH) (implies 15% haircut to market value)

$854mm for illiquid tokens

$11mm for alternative investments (implies ~95% haircut to book value as of July 31st)

Financing Source:

TBD, may include guaranty or other credit support from a DRW entity

Advisors:

In-house, to engage in second round

Conditions & Approvals:

Subject to diligence on timing to unlock illiquid tokens and investments

Source: Cumberland proposal as of November 21, 2022.

Note: Dollars in million.

(I) Consideration based on market prices as of November 18, 2022.

Novawulf Summary Term Sheet:

Transaction Structure:

Transfer substantially all assets (coins, loans and mining business) to SEC compliant NewCo (100% owned by the creditors)

Creditors receive pro rata allocation in two tokens representing (i) the value of Newco (“Asset Token”) and (ii) 0.5% management fee (“Rev Share Token”)

Rev Share Token:

Creditors benefit from profit sharing and upside from NewCo

Fee stream paid in USD / stablecoin

New coins issued in declining amounts

Asset Token:

Quarterly dividends in USD / stablecoin at Advisor’s / Board’s direction

Rev Share Token to be stapled to Asset token for one year (incentivize users to hold tokens)

Purchase Consideration:

NovaWulf would contribute ~$60-120mm of value to NewCo, consisting of cash consideration of 1.0-1.5x estimated year one management fees and 450-900mm HASH tokens

Management fees of $45-90mm based on estimated asset value of $2.25-$3.0bn

HASH token illiquid (quoted at $0.0015 on Coinbase)

Financing Source:

Funds under management and HASH token

NewCo Strategy:

NovaWulf would invest ~65% of NAV in digital assets on a long-only basis (e.g. BTC, ETH, USDC)

Target 8-10% return generated via secured / collateralized lending and staking

Enhance returns via securities investments (i.e. mining, institutional loans, private equity and VC portfolio)

Advisors:

[REDACTED NAME FOR PRIVACY] and [REDACTED NAME FOR PRIVACY] (investment banker)

Conditions & Approvals:

Approval by bankruptcy court in the U.S.

Other customary closing conditions

Source: NovaWulf proposal as of November 21, 2022.

I am only aware of these five bids on Celsius Network’s crypto assets. Binance is obviously the biggest name bidding on our assets, but Novawulf’s bid is particularly interesting in my opinion, because their bid seems to vaguely resemble Celsius Network’s newly-proposed restructuring plans… thoughts? 👀

Note: I’m happy to privately verify the authenticity of the bids, but I will not be posting the original bid documents publicly in order to protect my source’s identity.

PHISHING SCAMS & SPONSORSHIP

Ok ok, I know *sponsorships* are cringe (I’ve said no to most), but in light of all of these Celsius phishing scams popping up, I thought this would be an ~appropriate time~ to bring up my partnership with Aura. If you’ve followed me for a while, you’ll know I’ve never shilled a shitcoin or promoted an exchange for payment, but I actually love Aura.

Aura protects you from scammers & hackers by scanning the dark web for your emails, passwords, & social security number. Recently, Aura combed the dark web & found some of MY personal passwords, my home address & phone number leaked on the dark web. Aura automatically requested & removed them for me… bless ‘em. Along with a ton of other included features (e.g. financial fraud protection, VPN, identity theft protection, password manager, anti-track & safe browsing & antivirus software, etc), I HIGHLY RECOMMEND TRYING Aura even if just to check & see if your emails/passwords/sensitive info have been leaked. Aura will automatically request. removal of sensitive info.

For a 14 day Aura free trial sign up at: aura.com/tiffany

You can literally cancel anytime.

ANYWAY, THAT’S ALL. What are your thoughts on the bids? I’ll post more about all of this soon. Here’s me talking about the bids:

MY LINKS:

YouTube / Twitter / Instagram / Patreon / Aura Free Trial / Ledger Referral Link

EMAIL:

Cumberland looked like it was worth a follow-up. Seems Celsius and their lawyers just want to take creditors’ money one way or another. CelsiusUCC seem to have been neutered

Also note, nobody wants CEL